Matt Stoller is a fellow at the Roosevelt Institute. You can follow him at http://www.twitter.com/matthewstoller

The economy bulls are back at it again, claiming that all is well. The most recent edition of this story is, ?Consumers Paying Down Debt Helps Boost U.S. Expansion?, in a Bloomberg?piece written by Rich Miller, Steve Matthews and Elizabeth Dexheimer. It?s a well-reported piece, replete with Mark Zandi quotes, that mixes financial analysts sounding the all clear with anecdotes of people who have paid back their overwhelming debts, and are now shopping again.

This is the thesis.

Three-plus years into a recovery from the worst financial crisis since the Great Depression, Americans finally are getting their finances back into shape, Federal Reserve figures show. Household debt as a share of disposable income sank to 113 percent in the second quarter from a record high of 134 percent in 2007 before the recession hit. Debt payments on that basis are the?smallest?in almost 18 years, while the delinquency rate for credit cards?is the lowest?since the end of 2008?

Consumers such as Atlanta?s Bullock-Morley also have broken with the past. The health-care worker says she?s ?changed my lifestyle? with the help of Atlanta credit-counseling service CredAbility. She?s down to one credit card, has set aside about $500 for a trip to?Italy, put money into her personal emergency fund and is saving more for retirement. ?I just spend money very differently right now.?

Unfortunately, the economy bulls are leaving something very significant out: defaults. The data is pretty clear. In the latest quarter, first and second lien charge-offs were $303.7 billion (with Home Equity Lines of Credit defaults high and continuing to rise). Meanwhile, aggregate consumer debt dropped by $53 billion. That?s better than 2012 Q1, but the drop in debt from defaults is six times larger than the total drop in debt.

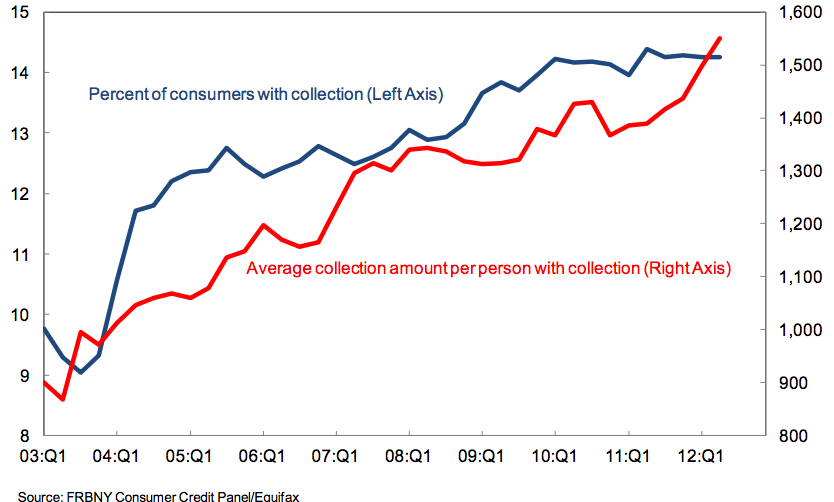

Consumers aren?t paying down their debts, they are simply defaulting. And here?s another way to look at the problem. One in seven Americans is being pursued by a debt collector. And the average amount of that debt pursued has increased by about 8% in just six months.

When debt collectors are doing a brisk business, the consumer typically is not.?The American consumer is still a very stressed consumer

dr. oz heart attack grill las vegas the heart attack grill joe kennedy iii joseph kennedy iii ghost hunters lightsquared

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন